Reported earnings are an inadequate measure of economic progress at Berkshire, in part because the numbers shown in the table presented earlier include only the dividends we receive from investees -- though these dividends typically represent only a small fraction of the earnings attributable to our ownership. Not that we mind this division of money, since on balance we regard the undistributed earnings of investees as more valuable to us than the portion paid out. The reason for our thinking is simple: Our investees often have the opportunity to reinvest earnings at high rates of return. So why should we want them

paid out?

根據GAAP規定, 公司除非持股量達到一定百分比, 否則只有股息和Capital Gain 會被認為是盈利記錄在公司Profit&Loss里。(具體百分比忘了, 會計專業歡迎分享。)

To depict something closer to economic reality at Berkshire than reported earnings, though, we employ the concept of "look-through" earnings. As we calculate these, they consist of: (1) the operating earnings reported in the previous section, plus; (2) our share of the retained operating earnings of major investees that, under GAAP accounting, are not reflected in our profits, less; (3) an allowance for the tax that would be paid by Berkshire if these retained earnings of investees had instead been distributed to us. When tabulating "operating earnings" here, we exclude purchase-accounting adjustments as well as capital gains and other major non-recurring items.

The following table sets forth our 1999 look-through earnings, though I warn you that the figures can be no more than approximate, since they are based on a number of judgment calls.---

(1) Does not include shares allocable to minority interests (2) Calculated on average ownership for the year (3) The tax rate used is 14%, which is the rate Berkshire pays on the dividends it receives

Berkshire's Approximate Berkshire's Share of Undistributed Berkshire's Major Investees Ownership at Yearend(1) Operating Earnings (in millions)(2) American Express (AXP) Coca-Cola (KO) Freddie Mac .... The Gillette Company .... M&T Bank (MTB) Washington Post (WPO) Wells Fargo (WFC) Berkshire's share of undistributed earnings of major investees Hypothetical tax on these undistributed investee earnings(3) Reported operating earnings of Berkshire Total look-through earnings of Berkshire

Naturally, most portfolios do not have operating earnings so the undistributed earnings minus hypothetical taxes is the "look-through" earnings. The calculation is a worthwhile exercise. I gauge the progress of a portfolio primarily based upon the growth in those "look-through" earnings over time not the change in stock prices.

This helps erase the noise that is created by market prices. If the "look-through" earnings grow at a satisfactory rate, while the competitive advantages of the businesses remain in tact (or ideally become larger over time), then returns will work out just fine in the long run.

Well, at least if shares were bought at fair prices in the first place.

Warren Buffett 認為這方法無法合理的體現出公司的盈利情況。年報中, 都會另外使用Look Through Earning 的方式來向股東解析公司具體盈利情況。

計算方式可參考以上年報中的Highlight的部分、 簡單的說就是公司保留盈餘 x 持股比例 - 估算應繳稅務。

Warren Buffett認為這種算法能幫助清除股價造成的市場噪音, 讓投資者看清公司真正的表現。如果“look through" earning 增長合理, 公司的競爭優勢依然穩健, 長期來說回籌自然會不錯。

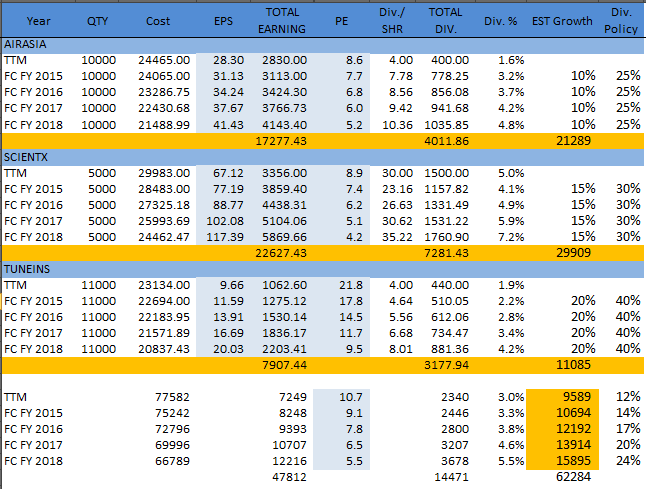

假設自己有一家公司,例如叫 【股海集團】, 以下是集團旗下公司營業概況:

以上是按虛擬組合計算出來5年Forecast 的 Look Through Earning.

TTM(time to month) 是最新4個季度的加總。 只要上網找出每股EPS,乘手中持有股數, 就能算出持有公司真正的盈利Total Earning。

【股海集團】2014年總投資額 Rm77,582, 各公司一年來為【股海集團】賺了Rm7,249, 身為集團主席兼大股東的我預計可收到 rm2,340的股息分紅, 可以選擇花天酒地或者繼續投資【股海集團】。

保守的算出5年的預估增長。 5年內, 這3家公司預計會為【股海集團】帶來Rm47,812的盈利, 其中Rm14471預計會是股息分紅, 其餘會作為保留盈餘(Retain Earning), 繼續擴展公司業務。

*由於虛擬組合中的FACBIND和ICAP比較特殊, 就不包含在以上估算中。

問自己幾個問題:

- -當初支撐購買該股的基本面, 是增強, 維持, 還是減弱?

- -5年之內持股公司是否有能力穩定盈利?

- -現在,或不久的將來,有沒有任何事情(經濟, 競爭, 國際局勢)會嚴重影響公司長期盈利的能力?

- -能否維持穩定派息?如果答案都是正面的, 那就沒什麼好擔心的了。 當然, 以上是以長期投資做的考量, 如果只是大算持有1-2個月, 以上算法基本不適用。

"I am a better investor because I am a businessman, and a better businessman because I am an investor." - Warren Bufett把自己當成生意人, 認真管理自己的組合, 無須讓自己血花紛飛的股市影響了心情,試著理性分析持有公司的Look Through Earning, 想想當初買入的原因, 心情自然會好。

2 comments

commentsWow, Excellent post. This article is really very interesting and effective. I think its must be helpful for us. Thanks for sharing your informative.

Replyeasy earning way | earn money online | social bookmarking sites list | article submission sites | blog commenting sites | forum posting sites | press release sites list | outsourcing | off page seo | seo tutorial | free seo tools | directory submission site list | freelancing | social exchange sites

free movie downloads | free movies online | movies | movie trailers | horror movies | hindi movies

popular sports in USA | United States favorit sports | most played sports in USA | most watched sports in USA | star cricket live | cricket live | star sports live streaming | football scores | live football streaming

islam | muslim | singles | marriage | quran | religion | quran real audio

GAAP 50% above only count

Reply